Picture a small farming town a hundred years ago.

Each family owned a barn, maybe a few animals, and a simple home. Every so often, a barn would catch fire, a storm would roll in, or a neighbor’s wagon would crash — and when those things happened, the cost was substantial. For one family alone, it might be financially devastating.

So the farmers got together and came up with a plan: everyone would contribute a small amount each season, and if something happened to one of them, the group would help cover the loss. The idea was simple — no one could predict disaster, but together, they could protect each other from ruin.

That’s the core of how insurance still works today.

Today, that same principle protects millions of families. We all pay into a shared system — and when a loss happens, the system steps in to help.

How Insurance Companies Stay Financially Healthy

To keep that shared safety net working, insurance companies track a few key numbers to measure how they’re doing:

Combined Ratio (CR)

This is the industry’s performance score. It compares how much the insurer pays out (in claims and expenses) to how much it brings in (from premiums).

- Below 100% means the insurer is making money from its core business.

- Above 100% means it’s losing money on the policies it sells.

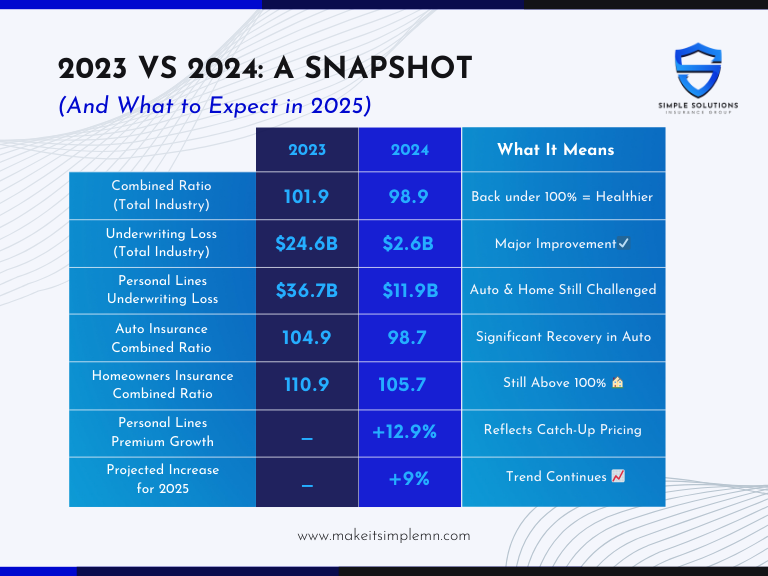

In 2023, the industry was above 100% — not a good sign. In 2024, things improved and fell back under 100%, which is a move in the right direction.

Underwriting Loss

This is the dollar amount an insurer loses when claims and expenses exceed premiums. In 2023, that loss was a staggering $24.6 billion. By 2024, it improved dramatically to $2.6 billion — still a loss, but much more manageable.

Rate Adequacy & State Involvement

If insurers consistently lose money, they request rate increases to return to financial health. But here’s the thing: they can’t just raise rates whenever they want.

Insurers must get state approval for any rate change, and states only approve increases if they can be justified by data. If the insurer can’t get those rates approved — and can’t stay financially sound — they may stop offering coverage in that state entirely.

So Why Do Rates Go Up for People Without Any Claims?

Even if you’ve never filed a claim, you’re still part of a shared risk pool. Your premium doesn’t just cover your personal risk — it helps cover the rising cost of claims across your area, your state, and the industry as a whole.

Inflation, more expensive repairs, record-setting weather events, and a rise in severe accidents all impact premiums — even for customers who’ve never needed to use their coverage. It’s not personal — it’s how the system remains sustainable for everyone.

Final Thought

Remember, insurance isn’t just a bill — it’s a community safety net. And while premium increases are frustrating, they’re part of how the system stays strong enough to protect you when you need it most.

Let’s review your policy together — make sure you’re getting the right coverage, and that every dollar is working for you.